What Is Cryptocurrency?

Herein, we will tell you about the principles of work, history of invention, and benefits of money of the 21st century. Our site FAQBitcoin is a reliable guide both for experienced cryptocurrency users and for newcomers. This review does not contain any specific technical information or details about the software engineering, but we will try to make it useful and interesting for all readers.

What do you imagine when you hear the words “progress” and “technologies”? Spaceships, medications, internet, gadgets, cars, and even weapons, our civilization is at the cusp of a new technological revolution in every aspect of life. No, we did not forget about the one thing which plays one of the greatest roles in our lives. Money. High tech has come to our wallets, too, and the 21st century started with huge innovations in payment systems, assets, and monetary units. In this article, we will talk about cryptocurrencies.

What is cryptocurrency? The commonly accepted definition of this term is as follows — a cryptocurrency is an electronic payment instrument that employs cryptography to emit new payment units, confirm the transactions, and protect the payments from hacking and double spending. Still, for beginners it remains a strange word with a shadowy meaning.

Let’s start with the basics — cryptocurrency is money, but not the usual money. First of all, it is not material and works exclusively on the internet. Here we have the first characteristic of cryptocurrency — it is digital. It is not issued by national banks and mints, and neither it is controlled by any jurisdiction.

Thus, the second characteristic is that cryptocurrencies are decentralized. And the last thing — cryptocurrency uses the public ledger to document all transactions. This database with the entire history of transfers is built with the help of cryptography, which is a special technique of encoding and securing information. Hence, the simple explanation of cryptocurrency for “dummies” would be like this — it is digital money that is not governed by any officials and operates exclusively with the help of special software and protocols.

Table of Contents

History of Cryptocurrencies

We did not make a mistake when we said that cryptocurrency is a child of the 21st century. There were many attempts to find something to substitute national money during the 1990s. Ecash was the first one, and the idea of this digital cash system, when the owner of the assets stays unknown, was represented by David Chaum in 1983. Only in 1995 he brought it to life through his company DigiCash, Inc. It worked for three years till 1998, and was used to provide microtransactions for the clients of several banks in America and Europe.

Later, there were many projects implemented, but they all failed. The reason for their bankruptcy was that they did not solve the main problem of traditional electronic payments. Such projects, as DigiCash, Beenz, or Flooz, did not refuse the central authority which acted like a trusted third party to provide and confirm transactions. Thus, the electronic currencies could not live longer than the company that governed it.

The precursors of the first effective cryptocurrency Bitcoin were b-money and bit gold. They were never put into practice, but were the foundation of the work of Hal Finney, who created the system of reusable proof of work, and later — the invention of bitcoin. The latter was introduced to the world in late 2008 by someone who calls himself Satoshi Nakamoto. It is still the most successful and widely used cryptocurrency on the market.

Is It Legal?

The legality of crypto coins is still a matter of discussion. There are countries, Ecuador and Bolivia for example, where they are forbidden by law. Other jurisdictions, such as Switzerland and some states of the USA, try to build electronic money into their financial and legal systems. The U.S. Internal Revenue Service withholds taxes from BTC owners, while European countries develop laws to regulate the circulation of cryptocurrencies to prevent money laundering and illegal drug and weapon trade. Still, they do not forbid crypto money, and rather are trying to put it under control instead.

The laws differ from country to country, and they can change drastically. Japan accepts bitcoin as a legal tender, while China is thinking about banning it on its territory. Canada, the UK, Australia, Spain, and Finland equal cryptocurrencies to fiat money and goods. Greece, Portugal, and some other countries do not regulate these cryptographic assets at all.

Types of Cryptocurrency

Many other cryptocurrencies appeared and disappeared on the market with years. We will briefly discuss the most known ones that brought innovations to the technology of peer-to-peer crypto cash systems:

- Ethereum was conceived by Vitalik Buterin and emerged in 2015. It uses the Turing-complete Ethereum Virtual Machine for calculations and encryption. The basic coin of this cryptocurrency is ether. In 2016, its blockchain split into two separate ledgers — Ethereum (ETH) and Ethereum Classic (ETC);

- Litecoin uses a cryptographic algorithm scrypt instead of secure hash algorithm 2 (SHA-2), which is utilized in bitcoin system. It was the first cryptocurrency after BTC and was meant to become its younger sibling. Actually, it is a result of the Bitcoin fork. Litecoin generates new blocks faster than its older brother, every 2.5 minutes, and has a higher maximum amount of coins that will ever be released — 84 million. Another cryptocurrency that uses scrypt technology is Dogecoin;

- Bitcoin Cash is another Bitcoin fork;

- a cryptocurrency dash employs two tiers — miners and masternodes. Miners keep records of transactions, and masternodes facilitate two types of transfers. Dash users can choose the InstantSend type of transaction for speed or the PrivateSend one for complete anonymity;

- Peercoin, which was created by two co-authors, Sunny King and Scott Nadal, was the first to use the proof-of-stake along with the proof-of-work system. Blackcoin employs only the first variant;

- Ripple project does not have a blockchain and confirms the transactions not with mining, but with the iterative consensus of the participants. Ripple has its own currency, XRP, but it lets the participants use other currencies, too, in the form of debt obligations. This system was designed not as a store of value, but as a quick and secure provider of internet payments;

- cryptocurrency Monero, shortened as XMR, uses the CryptoNote protocol for encryption. It allows the users of Monero to stay completely anonymous. The emission of new coins is not limited, and it also differs this digital money from other cryptocurrencies;

- IOTA is the first cryptocurrency that maintains its ledger without blocks, a chain, and miners. A member of the network, when making a transaction, has to confirm two past deals. This technology is called Tangle. IOTA does not create new coins, as they were all emitted at the beginning;

- OneCoin stands apart from other cryptocurrencies, as it appeared to be a Ponzi scheme, which only posed itself as a virtual currency based on a public ledger. In January 2018, the stories about the raids in the OneCoin’s office were on the news in Bulgaria and Germany.

As you see, the cryptocurrency systems may have significant differences. But they all have some common features which make them related to each other. The most important and revolutionary aspect about the idea of the decentralized digital money is that such systems are self-regulated. They do not need any authority, and do not have any head office and court of directors. The systems are maintained by their participants. Thus, the cryptocurrency lives no matter what happens to major banks, exchanges, and national governments. And each particular user can be sure that no one can use the system for fraudulent profit.

How Cryptocurrency Works

From a layman point of view, it is rather hard to understand how cryptocurrency works. An ordinary user operates the special software on his personal computer or mobile device to store, send, and accept crypto coins. Such applications, referred to as cryptocurrency wallets, have electronic addresses and private keys. The former is like email — other participants use it to send you coins. The latter is your electronic signature which you use to prove that the transaction is made by you personally.

Behind the scenes, there is a distributed public ledger, where the entire information of all transactions is recorded. This bookkeeping is maintained by the cryptocurrency nodes that do the mathematical work to confirm and encrypt the data in transactions with the help of cryptography. Once the work is done, the transfer becomes irreversible. Confirmed transactions are organized in the unalterable chain of blocks. All members of the network have to agree that the data in the blockchain is correct in every particular moment. The nodes solve the mathematical tasks with the help of their computing powers, and most systems reward them with new coins for their work.

The technology of the public ledger eliminates the possibility of double spending. This way a receiver of coins can be completely sure that a sender is not trying to spend the same coins several times. Verifying every new transaction, the participants of the system have to confirm the previous ones, as well. This is why the ledger is stable and unalterable.

What Is Cryptocurrency Used For?

The advantages of using cryptocurrencies are numerous. First of all, no one except you has access to your funds. Secondly, you do not have to pay extra fees for transactions, as the system is self-sustained and there are no middlemen to facilitate the deals. Your account, as well as the entire operability of the cryptocurrency, is always with you as long as you have access to the internet. And the last, but not the least, is that you stay anonymous using digital money.

Thanks to these benefits, crypto coins have gained popularity and are used for a huge variety of purposes. Merchants buy and sell things and services with the help of virtual assets. There are different ways to earn bitcoins and altcoins. People play the market to raise some money. The list of gambling sites that work with crypto coins is growing constantly.

Such faucet sites, as Daily Free Bits, We Love Bitcoins, and others, let the visitors get some satoshis. They give small rewards for completing some PPC (pay-per-click) tasks, playing games, or for the time a visitor stays on the page and watches the advertisement.

There are platforms that provide borrowing and lending with cryptocurrencies for their users, for example, SALT, ETHLend, Unchained Capital, etc. There you may loan money to other users against a guarantee of their cryptocurrency funds, or borrow directly from the system against your crypto coins.

Buy Goods

The most widely accepted digital cash is bitcoin. You can buy things on the web, or right in the local store, by simply scanning the QR code on the price tag. Not only goods, but services too can be bought with crypto coins. Hotels, travel agencies, ticket services, entertainment companies, and more accept BTCs all over the world.

Other altcoins cannot boast of such wide acceptance, but the situation is changing as their popularity grows. For example, the App Store allows payments in most digital coins. A marketplace OpenBazaar works only with cryptocurrencies, and the site Gift Off sells the gift cards for more than 40 digital currencies, with Dash, Dogecoin, ether, bitcoin, etc. are among them. All the more, you can always exchange your coins for more popular BTCs.

Accept As Payment

What if you are not a buyer, but a seller? Do not lose your chances and join the world’s business leaders who are accepting bitcoins and altcoins already! All you have to do is to inform your customers that they can pay with cryptocurrencies.

You can install special terminals or use the QR code of your wallet address. There are also many online services that help businesses to accept bitcoins and altcoins for small fees. The sites CoinPayments, CoinGate, BitPay, and others are convenient and inexpensive gateways for cryptocurrency payments.

Invest

Cryptocurrencies become very popular and promising assets to invest money, especially after a lot of people raised huge profits when the prices of the crypto coins grew intensively. For instance, Ethereum became 27 times more valuable during 2016-2017, and its market cap increased hundredfold. Bitcoin showed even more impressive results, as its exchange rate soared from about 650 dollars per BTC in January 2017 to more than 19000 USD per bitcoin in December.

Be aware, though, that cryptocurrencies are the most volatile assets. After the significant growth, markets have shown an impressive correction, and in March 2018, the common trend of all crypto money is still to decrease in value. Another risk related to cryptocurrency investments is that different countries have different laws to regulate operations with virtual coins, and sometimes these laws are also very volatile.

Still, cryptocurrency exchanges remain a very popular way to earn money for market players. Bitcoin remains the most attractive asset for investors, though it has been giving up its position lately. In the beginning of 2018, the part of BTC in the total volume of cryptocurrencies is about 40%. Some of the most widely used and popular platforms to trade bitcoins and altcoins are:

- Coinbase. It is registered in San Francisco, and poses itself and the most user-friendly exchange. It allows its users to buy and sell most crypto coins and to play the market on GDAX;

- Kraken. Another trading platform from San Francisco, founded in 2011. For now, it is one of the most popular exchanges with low commissions and high trust level;

- Bitstamp is a European exchange that is headquartered in Luxembourg since 2011. It is famous with its advanced liquidity and high volume of trades.

New cryptocurrency exchange-traded funds (ETF) are being launched, and they promise to become the most effective way to earn money with electronic cash. What does bitcoin ETF mean? It is an investment instrument with bitcoins as the underlying asset. The price of your ETF share follows the exchange rate of BTC, enabling both day trading and long-term trend trading. With the help of bitcoin ETF, you can earn money investing in the BTC market without actually purchasing the cryptocurrency.

Major banks in America, like Morgan Stanley, tell about the numerous requests from their clients to have an opportunity to invest with crypto money. Unfortunately, these financial institutions prefer to avoid risks related to bitcoins and altcoins. The regulators want to understand why the coins grow and decrease in value and how they can control this process. For this, the bankers ask to give them a so-called master key to the blockchain. This idea, though, does not get any enthusiasm from the side of cryptocurrency users, as it kills the main and fundamental characteristic of digital money — decentralization and independence from any controlling entity.

Mine

If we review mining as another way to use cryptocurrencies, it looks like an instrument to invest with virtual coins. In one of the previous paragraphs, we mentioned the cryptocurrency nodes that solve the cryptographic task to create the blocks in the chain. They are miners. They use the powers of their computers to do the calculations and get new coins as a reward from the system for these services.

The most popular cryptocurrency for mining is bitcoin. Complexity of the cryptographic puzzle is proportional to a number of miners who take part in the process. When new miners join the network, the difficulty increases. The times when users could mine bitcoins with the help of an ordinary laptop are in the past. Here we are back to the thought that mining is an investment instrument — to succeed in it you have to buy a special, very powerful hardware which is called application-specific integrated circuit (ASIC). A mining rig is a general name for any CPU (central processing unit), GPU (graphic processing unit), or ASIC system that is used for mining. GPU and CPU rigs will never compensate their price at the current bitcoin difficulty.

Lately, farming has become a widespread business. A cryptocoin farm is a set of ASICs that combine their computation capacities to compete with other participants and solve the tasks faster. Obviously, those farmers who possess a more powerful hardware better earn money. To understand how many coins you can get with your ASIC, you have to see its technical characteristics, particularly the hash rate. It is a miner’s capacity, which is measured in Terra hash per second (Th/s). There are online mining calculators where you have to indicate the hash rate of your gadget and bitcoin difficulty, which is given by the system, and see how many BTCs you can get every day. When making calculations, do not forget about the costs of electricity, as the modern mining rigs consume a lot of kilowatts.

The difficulty increases, while the reward is cut in two every four years. In the year of 2018, it is 12.5 BTCs per each mined block, and the next halving is going to happen in 2020. Thus, such altcoins as Dogecoin and Litecoin are becoming more profitable for mining. Especially because even a user of an average desktop can easily raise some money using these cryptocurrencies.

How Cryptocurrency Mining Works

You will not understand the technology of blockchain without a general idea about the role of miners in it and how mining works. In simple words, miners manage bookkeeping and confirm transactions. When a new transaction is made, it gets in the so-called unconfirmed pool. A miner picks it and confirms. He or she gathers the confirmed transactions in the block, and then the information there has to be encoded with the help of cryptographic algorithms. Actually, the miner’s computer has to guess the correct combination of numbers, where the entire information about all transaction in the block is encrypted. Furthermore, there should be information about the previous block included, too. Thus, the chain becomes more stable with every new block. Another purpose of mining is to provide the emission of new units. Most cryptocurrency systems issue coins as a result of adding new records to the ledger.

How to Buy Some Crypto Coins?

The easiest and, in some way, the best option to buy crypto coins is to do it directly. You simply have to give your money to a cryptocurrency owner together with your wallet address. This way is good only if you trust the person who sells you the coins, but in the same time it provides complete anonymity, no fees, and the quickest procedure.

Other popular means to purchase the coins are special ATMs. The site Coin ATM Radar contains information about more than 2500 machines in 65 countries, and these numbers are constantly increasing. Most of the ATMs work only with bitcoins, but you can also buy dash, Litecoin, Dogecoin, or ether. Dozens of cryptocurrency exchanges trade the most popular digital money. LocalBitcoins, Paxful, Kraken, Coinbase, and many others are among them. Gift cards are another way to acquire BTCs or altcoins.

Where to Store My Coins?

Crypto coins cannot be kept in a pocket, a safe, or in a bank deposit. They are not material, so they require some special methods. First of all, you have to understand that you do not store the coins, but only the private keys, which are used to access your money and approve transactions. These keys are kept in so-called cryptocurrency wallets. You should not lose the private key, as it means you lose your units forever.

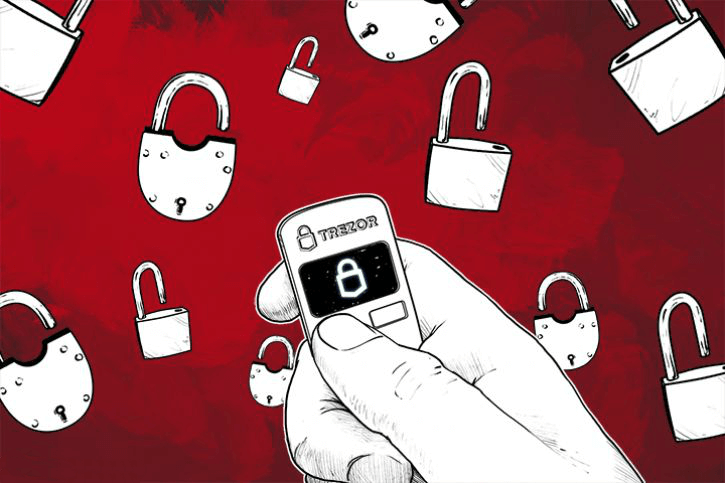

There are several types of cryptocurrency wallets. Hardware storages are the most secure ones. USB devices, like Digital Bitbox, TREZOR, Ledger Nano S, KeepKey etc., store your information offline and only you have access to it. A paper wallet with two printed QR codes can be used to send and receive assets. Software wallets are installed on your computer or cell phone, while online ones do not require any installation and operate entirely on the internet.

Common Terms in Cryptocurrency World

In this text or somewhere else, you could meet some words and phrases that you do not understand. Here are some of the terms that are frequently mentioned on the web. These little details about the cryptocurrency technology are very important for better cryptocurrency understanding.

51% Attack

There is a theoretical possibility that a group of members can acquire a computing power that will exceed all other miners combined. Thus, they would have more than 51% of all mining capacity. If it happens, these miners will be able to control the network and use it for a fraudulent profit. Luckily, this theory will never come true.

Block, Block Reward

A block is a data unit in a public ledger. It contains the information about each transaction — particularly, the amount, addresses of a sender and receiver, and the date when the transaction was made. These records in each block are encoded into a randomized subsequence of numbers. A block reward is a certain amount of crypto coins, which are given to a miner for finding the right code and adding the block to the chain.

Blockchain

The chain of blocks, which we call the blockchain, is a technology to keep transaction records. It is a public ledger, distributed on the network, transparent and unchangeable. The complete history of deals, from the first transaction to the current moment, is stored there.

Proof of Stake, Proof of Work

Miners have to solve the proof of work to create new blocks. It means that the mathematical task they do is complex and power-consuming enough to be worth emitting new coins. Proof of stake is a system where users verify the transactions by showing that they own a necessary number of coins. In simple words, they are requested to stake some crypto money to maintain the ledger.

Drawbacks to Using Cryptocurrency

The disadvantages of cryptocurrencies are few, but they can seem essential for someone. First of all, the rates of virtual money are very volatile. You never know when it will go up or down. Possibly, things will get better when the digital cash takes its place on the market and more people and companies use it as a medium of exchange.

This volatility is usually explained by the comparatively small part of cryptocurrencies on a global market. Too few people use them as a payment unit, not many businesses accept them, and traditional cash and credit cards have a higher acceptance rate. All the more, some countries outlaw them at all.

FAQ Section

To help you learn everything you need to know about cryptocurrencies in order to use them to the benefit, we gathered the most frequently asked questions about virtual money. We tried to answer them in the most readable and intelligible manner. Hopefully, this will encourage you to get started with crypto coins and guide through the difficulties and lack of understanding.

Can Cryptocurrency Be Hacked?

Usually, cryptocurrency protocols are resistant to hacker attacks. Still, virtual currencies are a popular target for thieves and frauds. In the very beginning, they successfully hacked bitcoin code and issued almost 200 billion of counterfeit BTCs. In a couple of hours, the mistake in the security system was fixed and the scam transactions were eliminated from the blockchain. It still stays the most essential hack of the cryptocurrency protocol. As you see, it did not have any consequences.

This does not mean, though, that your coins cannot be stolen. Exchanges, wallets, and trading platforms can be exposed to the risk of jailbreaking. To protect your money, keep them on hardware wallets and use the additional measures to advance the security of your funds, for example, multisignature.

What’s the Difference Between Cryptocurrency and Digital Currency?

Cryptocurrency is digital, but not all digital monies are cryptocurrencies. This means that crypto coins are a kind of digital currency that has special characteristics. These distinguishing features are exclusive to cryptocurrencies. Here are the main differences:

- digital currencies are not necessarily decentralized, they may have a central authority, just like fiat money;

- cryptocurrencies do not require the personal identification of their users, unlike digital money;

- digital money are not transparent, as the bookkeeping is held by the trusted third party and is usually confidential;

- the greatest advantage of digital currencies is that they are regulated by most jurisdictions.

For better understanding, we will refer to digital money as online bank services.

What Is the Best Cryptocurrency?

Every user has to answer this question individually. Some people prefer Litecoin and Dogecoin for easy mining, while others use bitcoin for its wide acceptance and usability. Ethereum has gained great popularity lately, for its blockchain provides smart contracts. Dash and Monero offer the highest level of anonymity. You need to learn all pros and cons of all cryptocurrencies and decide for yourself. We would advise you to choose one of the most widely used ones like bitcoin. By the way, you can do it with the help of the sites we have already mentioned in this article:

- see which cryptocurrencies can be bought with ATMs on Coin ATM Radar;

- check what crypto assets are traded on the most popular exchanges (e.g. Kraken or Coinbase).

We hope the information in this work will help you to make the right choice.

Cryptocurrency Wallet: What Is It For?

A cryptocurrency wallet is actually an application, which can be set up on your computer, mobile device, or on the web. Digital wallets are necessary for those who want to operate bitcoins and altcoins. They contain the public and private keys of users. Using these keys and the software of the wallets, their owners can send and receive coins.

What Gives Cryptocurrency Value?

The most important reason why cryptocurrencies have value is because people want to have them. As long as demand exceeds supply, users will be ready to pay money for crypto coins. Another question is why are they in such high demand. First of all, it is because they are designed to work differently from fiat money. Thus, they can perform some actions that traditional currencies cannot. When something has unique features, people will be interested in possessing it. Cryptocurrencies promote fast and anonymous international shopping and trading, they do not need your name and address, and do not care about your citizenship. Such characteristics let them enjoy great popularity and increase their value.

What Is the Future of Cryptocurrency?

It is not our intention to make any predictions. The world of cryptocurrencies is young and unstable; new names appear here and there, and old ones drown and disappear. Bitcoin seems to have the most positive perspective, but even its future is unclear.

It stays unknown what the national governments will do and how they are going to regulate cryptocurrencies. The markets are also very volatile. Still, the interest of people in crypto coins grows, keeping the money of the 21st century running. We discussed the sources of its value, and we will say it again — as long as cryptocurrencies stay an attractive and beneficial investment instrument, payment method, or means of making savings, their future is glittering.

What Is Cryptocurrency Fork?

A cryptocurrency fork is a change in the protocol that leads to a split. When a soft fork happens, this split creates a single blockchain and a single coin that remains on the market. A hard fork brings two ledgers and two separate currencies to life. The examples of hard forks are Bitcoin Cash, Ethereum, and Bitcoin Gold.

What Cryptocurrency to Invest In?

It is almost the same question about what is the best cryptocurrency. Investments and playing the market have one purpose — to earn some money eventually. So, the best investment instrument is the one that grows in value. Certainly, no currency shows constant growth, as prices change every day. Thus, you should choose the one which is traded on the most markets and has the highest credibility. This seems to be bitcoin for the moment. But the situation may change with time, as no one can know today which cryptocoin will bring the hugest profits tomorrow. And the advice will be the same — you should not limit yourself to one cryptocurrency; it is better to invest with the most popular ones. This way, you will have a guarantee that you will not lose it all at once.

What Is a Cryptocurrency Hash?

A cryptocurrency hash is generated by a mining rig, when a miner adds a new block to a chain. It is a subsequence of numbers, a code that contains the entire information from the block. A hash algorithm is used to encrypt large volumes of information into a hash, and even the slightest changes in this information will completely change the code. This is why, when the block is published in a ledger, it is impossible to change the data there.

The Bottom Line

In conclusion, we would like to encourage our visitors to use cryptocurrency. Even if it is completely new and geeky to you, with our site FAQBitcoin you have nothing to worry about. With us, you can explore the new possibilities of storing and investing with cryptocurrencies, buying goods and services all around the world, and enjoying the anonymity and freedom from financial regulators. Every day, new companies join the family of those who work with crypto coins. The acceptance grows, along with the part of crypto money on the global market. Do not trail far behind the progress, try cryptocurrencies for trading, payments, and doing business.